sales tax in austin texas 2021

ED Sales Tax Austin Dec 3 Location 4415 S IH 35 Frontage Rd Austin TX. No-New-Revenue MO Tax Rate.

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

This property is not currently available for sale.

. Rates include state county and city taxes. The minimum combined 2022 sales tax rate for Austin County Texas is. The latest sales tax rates for cities in Texas TX state.

Friday November 26 th 2021. The National Association of State Budget Officers estimates that the overall expenditures for the state of Texas in the fiscal year 2021 were 1432 billion. Total sales tax revenue for the three months ending in April 2021 was up 45 compared to the same period a year ago.

Tax sales are held the first Tuesday of the month at 10 am. The calculator will show you the total sales tax amount as well as the county city and. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

What is the sales tax rate in Austin Texas. The minimum combined 2022 sales tax rate for Austin Texas is. Off Market Homes Near Stratford Dr.

City sales and use tax codes and rates. The Austin sales tax has been changed within the last year. 2020 rates included for use while preparing your income tax deduction.

Sales tax in austin texas 2019 Monday June 6 2022 Edit Box 149348 Austin TX 78714-9348. NOVEMBER 1 2022. Access Top US Expat Tax Service In Minutes.

Click here to find other recent sales tax rate changes in Texas. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. On the West steps of the county courthouse 1000 Guadalupe St Austin TX 78701.

Stratford Dr was last sold on Nov 4 2021 for 5200. Dec 3 rd 2021. Stratford Dr Austin TX 78746 is a lotland.

Texas Comptroller of Public Accounts. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special. 2021 Federal Funding to Texas.

You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. This is the total of state county and city sales tax rates. What is the sales tax rate in Austin County.

Sales tax is the largest source of state funding for. As of April 1 2019 HomeAway and. The State of Texas assesses a 67 gross receipts.

Texas Sales Tax. This is the total of state and county sales tax rates. Wednesday March 10 th 2021 Registration Close.

It was raised 175 from 65 to 825 in October 2022.

Most Texans Pay More In Taxes Than Californians Reform Austin

Mississippi Among States Where Sales Tax Is Largest Revenue Source Mississippi Today

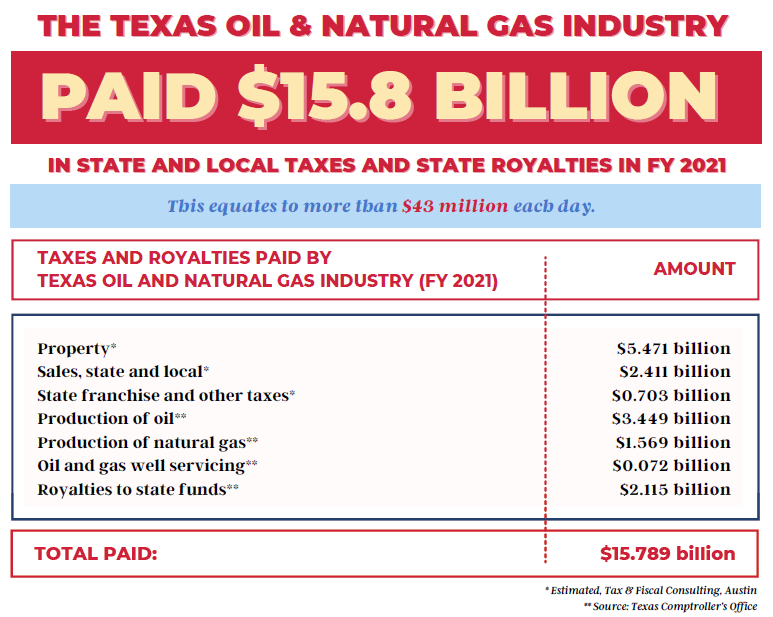

Texas Oil And Natural Gas Industry Paid 15 8 Billion In Taxes And State Royalties In Fiscal Year 2021 Texas Oil Gas Association

2022 Property Tax Rates Austin Tx Virtuance Real Estate Photography

13 Things To Know Before Moving From Colorado To Texas

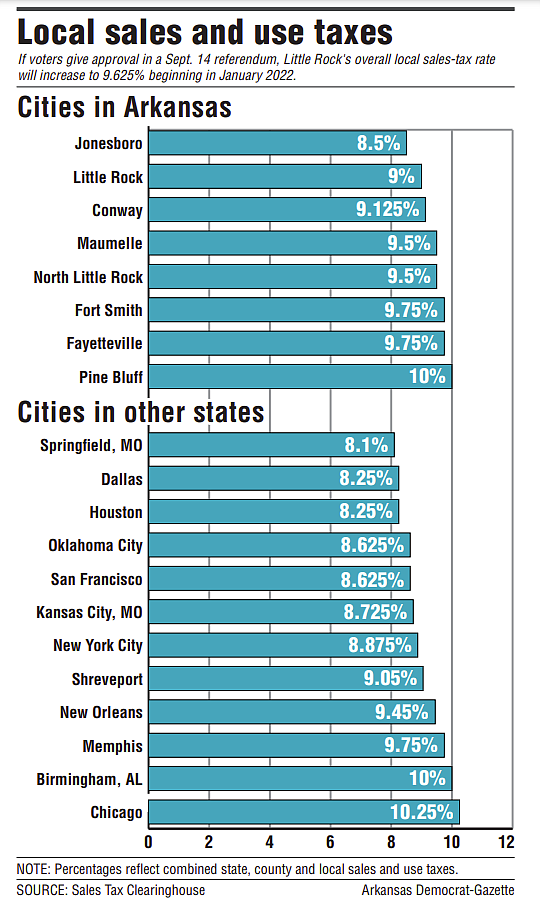

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

Texas Sales Tax In A Nutshell Quaderno

Austin Proposes 4 5 Billion Budget With Tax Revenue Hike Holding At 3 5

2022 Cost Of Living In Austin Texas Bankrate

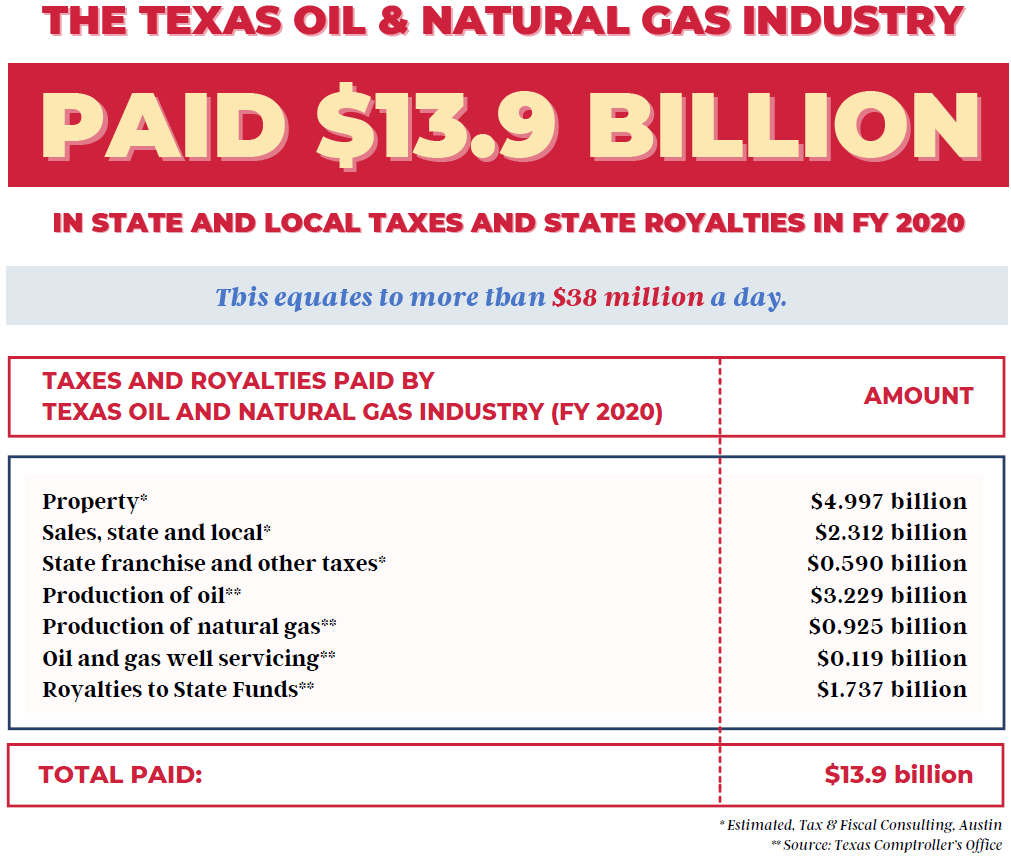

Texas Oil And Natural Gas Industry Paid 13 9 Billion In Taxes And State Royalties In Fiscal Year 2020 Texas Oil Gas Association

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How To File And Pay Sales Tax In Texas Taxvalet

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Austin S Housing Boom New Study Shows Which Zip Codes Are Seeing Most Growth Post Pandemic Kvue Com

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org